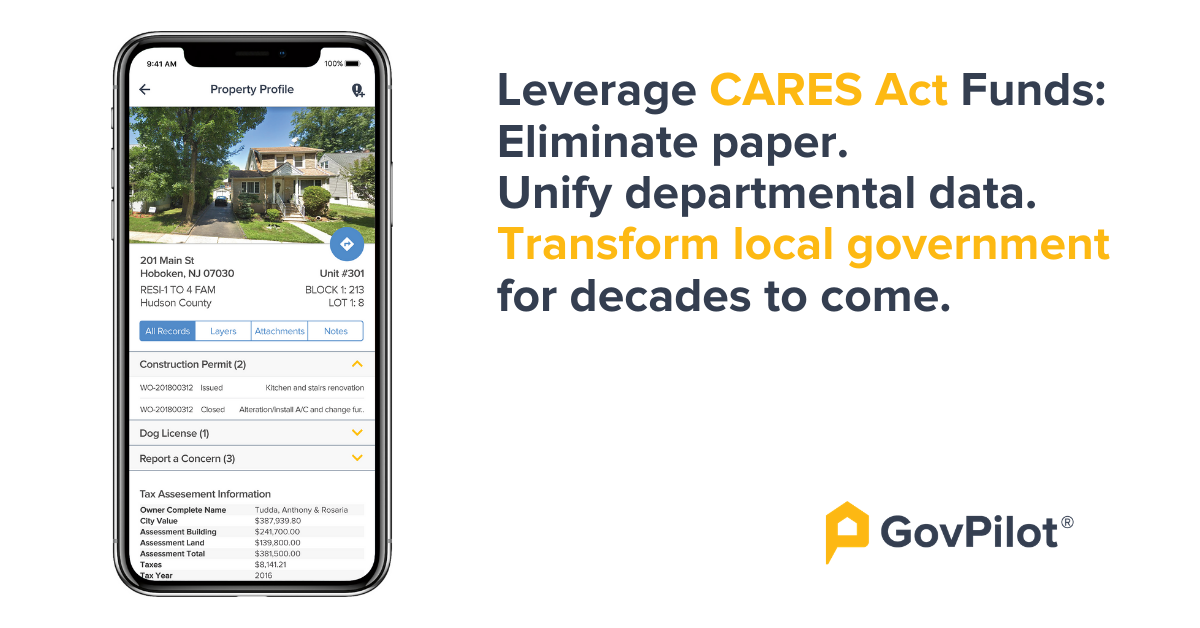

In an era characterized by rapid modernization, increased constituent expectations, shrinking budgets, and unpredictable outside disruptions, local governments’ reliance on arcane paper-based processes drains its scarce resources and limits its ability to effectively serve constituents.

COVID-19 and the required response, has had a significant impact on the budgets of local governments which has put a strain on services and staff. However, the $150 billion Coronavirus Aid, Relief, and Economic Security (CARES) Act passed by Congress in March 2020, represents a rare opportunity for local governments to invest in the modernization of IT systems and digital services. These investments solve short term needs such as increasing efficiency and enabling remote work, while simultaneously transforming local governments so that they can thrive in the digital age for decades to come.

In fact, the U.S. Treasury supports the deployment of CARES Act funds by local governments for technology acquisition including Software-as-a-Service (“SaaS”) contracts and remote-work upgrades.

To support local governments across the country as they grapple with COVID-19 public health emergency, GovPilot has introduced products specifically designed to ensure business continuity and enable remote work, social distancing, and the organization, tracking, and reporting of pandemic mitigation efforts.

These COVID-19 specific modules include:

- Coronavirus Related Receipting & Expense Tracking for FEMA Reimbursement

- Coronavirus Drive-Through Testing Resident Registration

- Volunteer Registration Module

- GIS Digital Mapping

- Report-a-Concern via the GovAlert App

- Work Orders

- Open Records Requests (FOIA & OPRA)

- IT Ticket Management

- Contract Tracking

- Vehicle & Equipment Management

- 125+ modules that unify departmental data and eliminate paper processes

To learn more about these digital modules please schedule a 15-minute consultation to speak with a GovPilot Solutions specialist.

Representatives from FEMA have indicated that software purchases may be reimbursable under the CARES Act if they address three key characteristics of eligibility:

- Helps identify the service impacts of COVID-19.

- Helps project and identify revenue shortfalls caused by the COVID-19 induced recession.

- Helps address continuity of operations planning

Digital cloud-based platforms that support sustained remote-work environments, increase efficiency, productivity, and cost savings while serving to keep constituents and employees safe now and in the future, represent a worthwhile investment in a world with or without COVID-19.

Now, an infusion of CARES Act funding has provided a rare opportunity for local governments to make a much needed investment in digitization and cloud-based processes that will pay dividends for budgets, constituent experience, and business continuity for decades to come.

The GovPilot team stands ready to help your government achieve its digital transformation goals. If you are interested in learning more about the digital transformation solutions offered by GovPilot, we would love to talk.

More About the CARES Act for Local Governments:

Per the terms of the CARES Act, local governments in need of software specifically to be used to help them respond to the COVID-19 health emergency may be eligible for CARES Act reimbursement, as long as the purchase was not accounted for in the municipality’s budget as of March 27, 2020, and the purchase is incurred between March 1 and December 30, 2020.

The U.S. Treasury Department will oversee and administer CARES Act payments to state and local governments. If a state or eligible unit of local government does not spend all CRF payments that are allocated by December 2020, Treasury will recoup these funds. If a unit of local government has a population of less than 500,000, it cannot receive direct payments from the U.S. Treasury. However, a state that receives a CRF payment is allowed to transfer funds to a unit of local government.

A county that received a payment may transfer funds to a city, town, or school district within the county and a county or city may transfer funds to its state, provided that the transfer qualifies as a necessary expenditure incurred due to the public health emergency and meets the other criteria of section 601(d) of the Social Security Act outlined in the Guidance.